carried interest tax rate 2021

Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues. On January 13 2021 the IRS posted final Treasury Regulations for Section 1061 of the Internal Revenue Code.

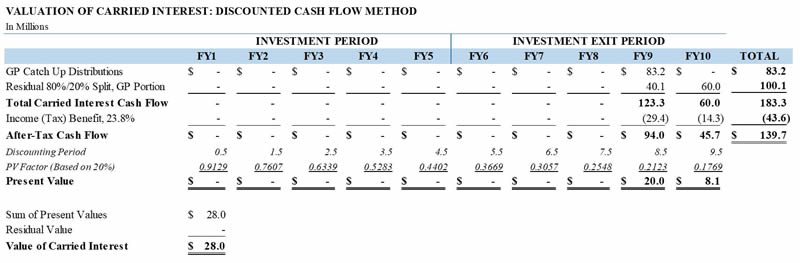

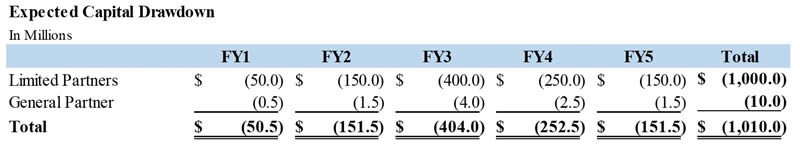

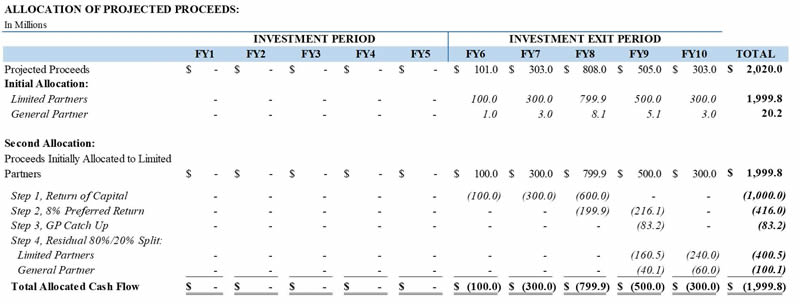

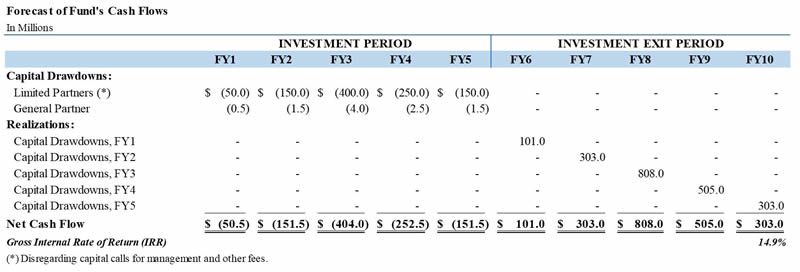

Carried Interest In Private Equity Calculations Top Examples Accounting

Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie.

. 7 2021 providing guidance on the carried interest rules under Section 1061. This 20 percent long-term capital gain rate is lower than the marginal tax rate applied to most families in 2021 single filers would pay a marginal tax rate of 22 percent of. The law known as the Tax Cuts and Jobs Act PL.

Contrast this with the highest tax bracket for ordinary income in any given year and thats a. Basically the goal of. On July 31 2020 the Department of Treasury and IRS issued proposed regulations the Proposed Regulations that provide guidance to the carried interest rules under Section 1061 of the Internal Revenue Code.

This item discusses proposed regulations that the IRS issued on July 31 2020 regarding the tax treatment of carried interests REG-107213-18Editors note. Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead of higher ordinary income tax rates. The managers pay a federal personal income tax on these gains at a rate of 238 percent 20.

Discover Helpful Information and Resources on Taxes From AARP. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax rate on income received as compensation rather than the ordinary income tax rates of up to 37 percent that. For those in the top income brackets carried interest is typically subject to the 20 capital gains tax rate plus the 38 net investment income tax for a total tax burden of 238.

Your 2021 Tax Bracket to See Whats Been Adjusted. Even within this exemption amounts can still be brought back within the DIMF rules if. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax.

A key exemption from these rules is the carried interest exemption which if met means that amounts should be subject to capital gains tax at a lower rate of 28. Section 1061 was enacted as part of the Tax Cuts and Jobs Act TCJA and requires a three. Ordinary income is generally taxed at a higher rate than LTCGs significantly higher rates depending on the taxpayers tax bracket.

The preferential tax rate is especially important for a private equity fund and its managers. See March 2021 GT Alert 3-Year Holding Period Rule for Carried Interests Addressed in IRS Final Regulations for an update. 2020 to 2021 2019 to 2020 2018 to 2019 2017 to 2018.

9945See news coverage of the final regulations here. Every president since George W. The carried interest tax loophole is an income tax avoidance scheme that allows Wall Street executives to substantially lower the amount they pay in taxes.

Some view this tax treatment as unfair because the general partner receives carried interest as compensation for its investment management services. For example if you earn a 1 million return on long-term investments in 2021 it will be taxed at the maximum rate for LTCGs which is 20. In general equity issued in exchange for services is taxable at ordinary income rates unless that equity is a profits interest.

The legislation is the culmination of an extensive consultation process. Tax incentives include 0 tax rate for carried interest. The Biden proposal would in many cases eliminate the availability of the lower capital gains tax rate for a partners share of income on an.

The IRS finalized these regulations in January 2021 with a few changes TD. Susan Minasian Grais CPA JD LLM. The IRS released final regulations TD.

Capital gain treatment would continue to apply for individuals who truly put money at risk such as private-equity partners who invest their own money in. Not including residential property and carried interest. The law known as the.

In January 2021 the US. 115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be eligible for capital gain treatment. In general APIs are partnership interests held by service providers or related parties.

Carried-Interest Tax Break Shrinks Survives in Democrats Plan Carried interest offers lower tax rate than for income Biden administration had proposed eliminating the tax break House Democrats. A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. Carried Interest In 2021.

Under current law carried interest is taxed as investment income rather than at ordinary income tax rates. Carried Interest Fairness Act of 2021. Dubbed the Carried Interest Fairness Act of 2021 or HR 1068 the bill would allow fund managers who put their own money in a funda common practice in private equityto still treat those profits as capital gains.

Proceeds from that individuals partnership interest are often taxed as capital gain rather than ordinary income. The final regulations generally retain the structure of proposed regulations issued last July but also make several important changes. Ad Compare Your 2022 Tax Bracket vs.

According to a news release from Pascrell Levin and Porter the Carried Interest Fairness Act of 2021 would tax certain carried interest income at ordinary income tax rates and subject it to employment taxes. Section 1061 increases the holding period required for long-term capital gains treatment from more than one year to more than three years for partnership interests deemed to be applicable partnership interests API. LTCG treatment and associated preferential tax rates for non-corporate taxpayers with respect to certain capital gains realized in connection with so-called applicable partnership interests APIs.

However income earned from managing a firms assets would be treated as regular income and taxed at the higher rate. This bill modifies the tax treatment of carried interest which is compensation that is typically received by a partner of a private equity or hedge fund and is based on a share of the funds profits. 18 and 28 tax rates for.

Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of. The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its third reading in the Legislative Council unamended and once published in the official gazette will become law.

Carried Interest What It Represents And How To Value It And Why Marcum Llp Accountants And Advisors

Carried Interest What It Represents And How To Value It And Why Marcum Llp Accountants And Advisors

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

How To Tax Capital Without Hurting Investment The Economist

Lp Corner Fund Terms Carried Interest Preferred Return And Gp Catchup Allen Latta S Thoughts On Private Equity Etc

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Carried Interest Plans Can Benefit Both The Fund Management Industry And Investors Intertrust Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Carried Interest What It Represents And How To Value It And Why Marcum Llp Accountants And Advisors

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

How Private Equity Conquered The Tax Code The New York Times

Doing Business In The United States Federal Tax Issues Pwc

How Private Equity Conquered The Tax Code The New York Times

Carried Interest Calculation Tax Loophole Understanding Pe Vc Youtube

Carried Interest What It Represents And How To Value It And Why Marcum Llp Accountants And Advisors

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)